Digital Assets, Market Integrity, and Market Transparency Highlight the CFTC’s Enforcement Focus from FY2023

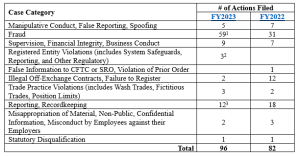

On 7 November 2023, the Commodity Futures Trading Commission (CFTC) Department of Enforcement (DOE) published its FY2023 enforcement results summary. The report identified a total of 96 enforcement actions and litigation victories which resulted in over $4.3 billion in penalties, restitution, and disgorgement. A breakdown of the 96 enforcement actions by violation type, compared to the data from FY2022, can be found in Appendix A.

Some of the key trends in the report included:

- an acute focus on digital assets;

- the prioritization of market integrity through matters relating to fraud, business conduct violations, and supervision failures; and

- a continued focus on reporting and recordkeeping to promote market transparency.

Separately, the recent Advisory Regarding Penalties, Monitors and Consultants, and Admissions in CFTC Enforcement highlighted changes in the DOE’s approach regarding enforcement actions and settlements moving forward.

The CFTC’s focus on enforcement and its increasing penalties for non-compliance should cause firms to prioritize good governance and ensure they have adequate resources to comply with applicable regulations.

Key Trends

Digital Assets

Not surprisingly, digital asset cases accounted for nearly 50 percent of total cases (47 of the 96) from FY2023. The majority of these cases dealt with fraud, in addition to enforcement categories such as manipulative and deceptive conduct or registration failures (e.g., illegally offering futures transactions on a platform other than a designated contract market).

Fraud, Business Conduct, and Supervision

The CFTC nearly doubled its enforcement of fraud cases from the previous year. Chairman Behnam reinforced this observation by saying that the CFTC “continues to remain laser-focused on stopping and deterring fraud and manipulation in the U.S.” This trend shows that the CFTC continues to bring enforcement actions targeting bad actors to ensure the integrity of derivatives and commodities markets.

In these cases, the CFTC not only targeted the bad actors who engaged in activities like spoofing or manipulative conduct, but also punished the firms at which this conduct was allowed to occur. Given this regulatory climate, it is critical for firms to ensure that they have strong policies and procedures and effective controls, including trade and communication surveillance, to mitigate the potential of fraudulent or manipulative conduct going undetected.

Reporting and Recordkeeping

Similarly, the CFTC continued to crack down on recordkeeping and reporting violations in FY2023 to promote market transparency. CFTC Director of Enforcement Ian McGinley highlighted failures in corporate compliance and enforcement in his remarks stating, “Multiple swaps dealers across the industry are continuing to fail to report accurately (or at all) millions of swaps. At the end of the day, the penalties need to exceed the costs of compliance, to avoid the risk of institutions viewing penalties as an acceptable cost of doing business.” Director McGinley’s remarks, along with the enforcement data, indicate that reporting will continue to be a focus for the DOE.

Separately, the CFTC brought several actions related to recordkeeping, specifically off-platform communications and/or the required retention of certain kinds of communications. Many of these cases also included charges of failure to supervise, which reiterates that establishing good governance around recordkeeping, approved communication methods, and record retention should be a high priority for firms.

Put Patomak’s Expertise to Work

Patomak has deep experience in designing and assessing compliance programs at banks, swap dealers, broker-dealers, digital asset trading platforms, and other financial firms. If you’d like to learn more about how Patomak can partner with you, contact Jill Sommers (jsommers@patomak.com), Mark Wetjen (mwetjen@patomak.com), Sudhir Jain (sjain@patomak.com), Joshua Kuntz (jkuntz@patomak.com), or Timothy Brown (tbrown@patomak.com).

Appendix A: Enforcement Actions Filed FY2023 v. FY2022

[1] 17 of these actions also included Failure to Register charges, while one of these actions also included false statements to the CFTC.

[2] The term “Registered Entity” is defined in 7 U.S.C. 1a (Section 1a of the Commodity Exchange Act) and includes, among other entities, designated clearing organizations, designated contract markets, swap execution facilities, and swap data repositories.

[3] 10 of these actions also included Failure to Supervise charges.