NFA Highlights Common Compliance Deficiencies for Swap Dealer Members

On February 12, 2024, the National Futures Association (NFA) published Notice I-24-05 (the Notice), which included its annual highlights of common deficiencies amongst its Swap Dealer (SD) members. NFA identified common deficiencies relating to the six regulatory areas noted below:

- Capital Requirements

- Calculation of Initial Margin Using Risk-based Models

- Swap Data Reporting

- Required Records

- Business Conduct Standards

- Market Practice

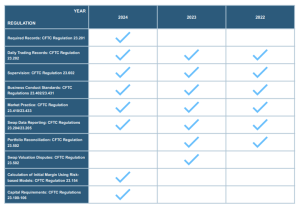

A high-level summary of the rule areas included is as follows:

- Capital Requirements and Calculation of Initial Margin Using Risk-based Models are new additions in the 2024 Notice.

- The remaining areas were identified by NFA in the 2023 and 2022

- Portfolio Reconciliation and Swap Valuation Disputes were mentioned in the 2023 notice but are not mentioned in this year’s notice.

A further description of each regulatory area is included below. Additionally, please refer to the Appendix for a list of rule areas NFA has cited in the past three years.

2024 NFA Common Deficiencies

Capital Requirements: The CFTC’s capital requirements for SDs are governed by Regulations 23.100-106. These rules became effective on October 6, 2021 and NFA commenced examinations covering capital requirements shortly thereafter. In the Notice, NFA reminds members that capital requirements are determined at the entity level. Therefore, the SD entity registered with NFA must comply with capital requirements at all times. Additionally, each entity that uses internal models for capital requirements must independently validate those models and have an ongoing monitoring program in place.

It is unsurprising that the Notice distinctly highlights the legal entity element for compliance with the minimum capital requirements. This is particularly important for firms that use models for market and credit risk. Though some firms may leverage established systems and processes maintained at the parent or group level (e.g., Bank Holding Company), it is crucial for firms to understand that they must establish risk management processes such as ongoing monitoring (e.g., benchmarking, back testing, etc.) at the legal entity level. Failure to establish these processes at the legal entity level can impair the ability to receive model approval or could lead to additional scrutiny and potential violations. These processes at the legal entity level are expected to be formally memorialized in policies and procedures, as well as ensuring that relevant monitoring and validation activities include specific carve-outs for the NFA regulated entity.

Initial Margin Using Risk-based Models: SDs that choose to calculate initial margin using a model are required to comply with oversight requirements set out in CFTC Regulation 23.154. As such, SD members must ensure that required activities including periodic validations, model performance monitoring, and internal audit reviews, are carried out. In this space, NFA noted the following deficiencies:

- Failure to adequately monitor model performance and report material performance issues;

- Failure to maintain adequate documentation supporting monitoring activities; and

- Failure to notify the CFTC and NFA in writing prior to events specified within CFTC rules.

Swap Data Reporting: The relevant rules that govern swap data reporting requirements are CFTC Regulations 23.204 and 23.205. NFA has repeatedly cited swap data reporting as an area of deficiency. The following swap data reporting deficiencies were new to this year’s Notice:

- Failure to reconcile open swap positions at the swap data repository against internal records; and

- Failure to notify the CFTC after determining an error would not be remediated within seven business days after discovery.

NFA examinations post CFTC rule-rewrite have included a review of the new trade reporting requirements, so these deficiencies are not surprising. In addition to these new requirements, NFA has commonly raised issues regarding real-time reporting timeliness and the failure to correct errors and omissions as soon as technologically practicable after discovery. For timeliness, firms should be cognizant that transactions executed via voice or electronic communication methods should have an execution time that reflects the time the trade was agreed upon in chat and not the time that the trade was booked for the purposes of tracking real-time timeliness. For errors and omissions, firms should have adequate processes to identify, track, and remediate issues within seven days. As NFA cited above, where unable to remediate issues within seven days notification to the CFTC is required.

Required Records: In accordance with CFTC Regulations 23.201 and 23.202, SDs are required to keep records of all their swaps activity and ensure that those records are complete and accurate. As in the previous year’s notice, NFA reminded SD Members that they should take preventative measures against the use of unauthorized or unrecorded channels for pre-execution trade communications.

This is also a rule area that the CFTC and SEC continue to charge firms for violating. Most recently, on February 9, 2024, the SEC announced charges against sixteen firms for failures related to maintenance and preservation of electronic communications.

Business Conduct Standards: SD Members are required to comply with CFTC regulations 23.400 through 23.451 governing Business Conduct Standards. Common deficiencies identified by NFA covering Business Conduct Standards include:

- Failure to properly identify and classify counterparties impacting other transaction specific requirements; and

- Failure to disclose material information and pre-trade mid-market marks (PTMMM) prior to entering uncleared swap transactions.

These deficiencies are repeatedly identified in annual NFA Notices. Furthermore, the CFTC has in recent history charged firms for failing to comply with these disclosures.

Market Practice: CFTC regulations related to market practice include: 23.602, which requires SDs to diligently supervise their swap activities; 23.410, which requires SDs to maintain policies and procedures to safeguard against fraud, manipulation, and other prohibited activities; and 23.433, which requires SDs to communicate with counterparties fairly and in a balanced manner. Common deficiencies in these rule areas included the failure to conduct adequate trade surveillance and/or maintain a reasonably tailored communication surveillance program.

Put Patomak’s Expertise to Work

Patomak has deep experience assisting SD Members in complying with CFTC and NFA requirements. If you’d like to learn more about how Patomak can partner with you, contact Jill Sommers (jsommers@patomak.com), Mark Wetjen (mwetjen@patomak.com), Sudhir Jain (sjain@patomak.com), Anne Montminy (amontminy@patomak.com), Timothy Brown (tbrown@patomak.com), or Joshua Kuntz (jkuntz@patomak.com).