CFTC Swap Rules for Renewable Energy Transactions: What VPPA Participants Must Know

Summary

Situation Overview: Virtual power purchase agreements (VPPAs) are classified as swaps under the Commodity Exchange Act (CEA). All firms engaging in VPPAs are obligated to comply with certain CFTC regulations, including non-financial firms utilizing VPPAs that otherwise would not be subject to such regulations.

What: Firms engaging in VPPAs must be eligible contract participants (ECPs) and prepared to report VPPAs to a swap data repository (SDR) in accordance with Parts 43 and 45 of the CFTC’s regulations.

Who: Renewable energy producers, project management firms acting on their behalf, and other entities that engage in VPPAs.

In Depth

The term “power purchase agreement” (PPA) refers to a contract between an energy buyer and an energy project developer that outlines terms for the purchase of energy and may include associated environmental attributes (e.g., renewable energy credits (RECs)).

These arrangements are typically set up by firms supporting the development of energy facilities. Such firms execute PPAs with counterparties prior to the energy facility’s development to secure revenue for the energy planned to be produced. PPAs subsequently become effective upon the energy facility’s development and commencement of full-scale operation.

PPAs generally fall into two categories: physical or virtual. Physical PPAs are long-term commodity forward agreements under which a counterparty pays a periodic (e.g., monthly) fixed price for a proportion of the electricity produced by a renewable energy facility (e.g., a solar or wind farm).

Physical PPAs may also include the exchange of RECs associated with renewable energy production, which businesses can use to make representations regarding sustainable business practices.

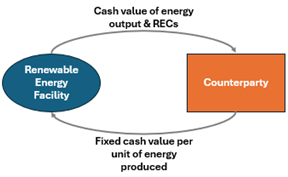

Instead of a physical PPA, firms may engage in a VPPA. A VPPA is similar to a physical PPA; however, rather than physically delivering electricity, the energy facility periodically pays its counterparty the market value (e.g., the price of electricity at a regional settlement hub) of the electricity it produces, as well as the RECs generated. The energy facility and counterparty generally net the payments and exchange the difference each period (e.g., if the fixed price was higher than the market price, the counterparty would pay the energy facility the surplus). See the figure below for a depiction of a typical VPPA.

Why Are VPPAs Swaps?

PPAs are not considered swaps under the CEA, which explicitly excludes physically delivered forwards from its definition of “swap.” However, as VPPAs are cash settled, they do not fit within this exclusion and are classified as swaps.

Product Type |

Settlement |

Swap? |

|

Physical PPA |

Physical | No |

| VPPA | Cash |

Yes |

Which CFTC Rules Apply to VPPAs?

As swaps, VPPAs are subject to the swap-related CFTC regulations described below.

- Both counterparties to the swap must be ECPs; and

- The swap must be reported accurately, completely, and timely to an SDR pursuant to Parts 43 and 45 of the CFTC’s regulations.

Reporting to an SDR pursuant to Parts 43 and 45 may prove particularly challenging for non-swap dealer entities that do not engage in swaps as their regular course of business. Such firms may not have developed an operational framework for compliance with swap reporting requirements.

Counterparties to a VPPA must establish who will be the “reporting counterparty” (i.e., agree on which party will report the VPPA to the SDR). Additionally, Parts 43 and 45 require the reporting counterparty to, among other things:

- Report swap data as soon as technologically practicable after execution for public dissemination, in accordance with CFTC and SDR specifications;

- Report additional non-public swap data no later than the end of two business days following execution, in accordance with CFTC and SDR specifications;

- File additional reporting pursuant to regulatorily reportable events throughout the life of the swap (g., change in effective and expiration dates based on the energy facility’s construction and completion, change to the swap’s economic terms);

- Correct any reporting errors within seven business days of discovery or notify the CFTC if errors cannot be corrected within seven business days; and

- Reconcile swap data in the firm’s books and records against all data reported to the SDR at least once every calendar quarter.

Some unique aspects of VPPAs present complications to regulatory reporting, particularly as it relates to certain CFTC-required data fields. For example, the notional quantity underlying the swap (the energy produced) may vary significantly each settlement period. Additionally, since VPPAs become effective upon the energy facility’s operation, the swaps’ effective and expiration dates are unknown at the time of execution and reporting. As these terms vary from those of more traditional swaps, reporting using the available CFTC-compliant templates can be complex.

While the CFTC has not provided guidance specific to reporting VPPAs, firms should report their swaps in a manner that provides as much information as possible to the SDR within the confines of the data fields required by the CFTC and requirements specific to their SDR.

Put Patomak’s Expertise to Work

Patomak has worked with firms reporting VPPAs to help evaluate their products against the CFTC’s specifications and specifications unique to their SDR, as well as develop processes for conducting regulatory reporting. Patomak welcomes discussions with firms with a potential need to develop or improve upon their swap data reporting. To learn more or discuss how Patomak can support your firm, please contact Sudhir Jain at sjain@patomak.com, Anne Montminy at amontminy@patomak.com, Tim Brown at tbrown@patomak.com, and Drew Godsell at dgodsell@patomak.com.